Introduction

A budget aligns spending with your life goals. This guide shows you how to build and refine a sustainable budget in just one week.

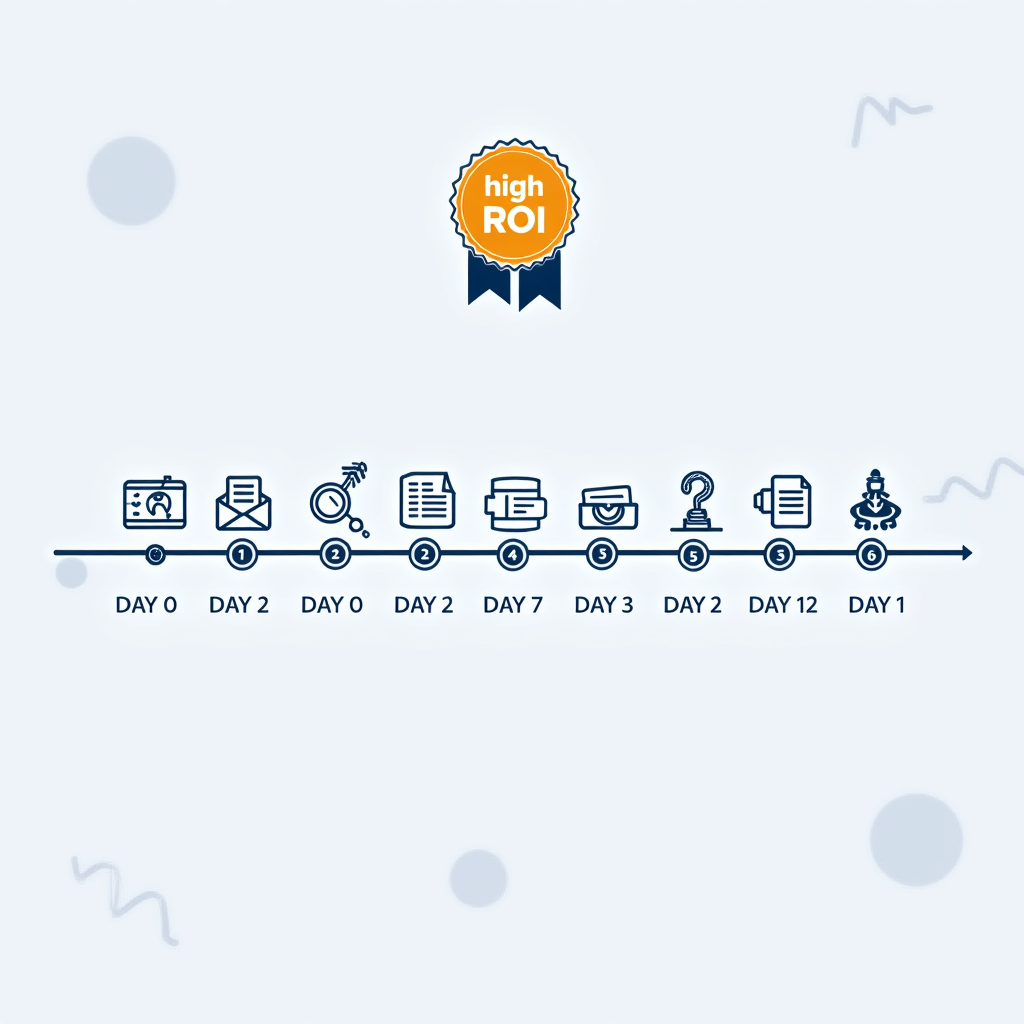

Day 1: Assess Your Finances

-

Review income and expenses using bank statements.

-

Action: Log them in Google Sheets.

Day 2: Set Financial Goals

-

Choose 1–2 goals (e.g., save $1,000, pay off $2,000 debt).

-

Action: Write one mindset shift like: “I’m learning to manage money.”

Day 3: Choose a Budgeting Method

-

Apply the 50/30/20 rule: 50% needs, 30% wants, 20% savings/debt.

-

Action: Categorize expenses within this framework.

Day 4: Use a Budgeting Tool

-

Track spending with YNAB or Mint.

-

Action: Import one month of transactions and categorize.

Day 5: Shop with a List

-

Prevent impulse spending by writing weekly grocery and essentials lists.

-

Action: Stick to your list.

Day 6: Automate Savings and Bills

-

Use autopay for bills and auto-transfer for savings.

-

Action: Schedule a $100 transfer to savings this week.

Day 7: Review and Adjust

-

Reflect on your first week and tweak categories as needed.

-

Action: Spend 30 minutes reviewing performance.

Outcome: A realistic budget that reflects your goals, reduces unnecessary spending, and steadily builds savings.

Subscribe to the Trusted Stak newsletter for more actionable financial strategies and step-by-step playbooks.

![Is Jasper AI Worth It in 2025? [Full Review + Affiliate Link]](https://trustedstak.com/wp-content/uploads/2025/02/217b4200-64d0-446a-8849-969950410bca-e1757354488987.jpg)